Impact Investing with Tropical Hardwood Trees

Las Azucenas is the registered name of a S.A. in Guatemalan. They work as an agroforest company, under the direction of Los Santos a California LLC.

Good Always is a Social Enterprise that is owned by the Stones of Light Education Foundation a 501(c)3 organization.

Where is Las Azucenas and Good Always Located?

Las Azucenas forest is located in the heart of the Mayan

Triangle in guatemala.

Good Always is helping impoverished communities throughout Guatemala

through education and job creation.

We are building communities through impact investing!

We are building communities through sustainable forestry, job creation, and high quality education!

Since 1910, what investment has consistently, year after year, been recognized as the number one ranking low-risk, high-return investment in the world?

Tropical Hardwood Timber!

Today, tropical hardwood timber is still recognized as the number one investment vehicle driving the world's best-performing portfolios. It is considered an investment category all its own!

Investing in High-Grade, High-Value Regenerative Tropical Hardwood Trees

A unique low-risk, high-return opportunity

Las Azucenas Proof of Concept:

2000 - Present

16 hectares of restored forest.

Commercial Project: Est 2017

45 hectares of degraded cattle farmland now home to tens of thousands of high-value tropical hardwood trees.

Tropical Hardwood Trees

There are three types of prized hardwoods on the farm: mahogany (Swietenia macrophylla King), cedar (Cedrela odorata L.) and ciricote (Cordia dodecandra Dc.)

Professional Tree Cultivation

The forest is managed by professionals with 30+ years of experience in cultivating tropical hardwoods. Read about Javier below:

Javier G Esquivel

Landowner and Manager of the Farm at Las Azucenas

Tropical Hardwood Trees

Javeir has over 30 years of professional and technical experience in forestry and agriculture.

Mayan Biosphere Involvement

He is a former director of the Mayan Biosphere a UNESCO recognized biosphere reserve.

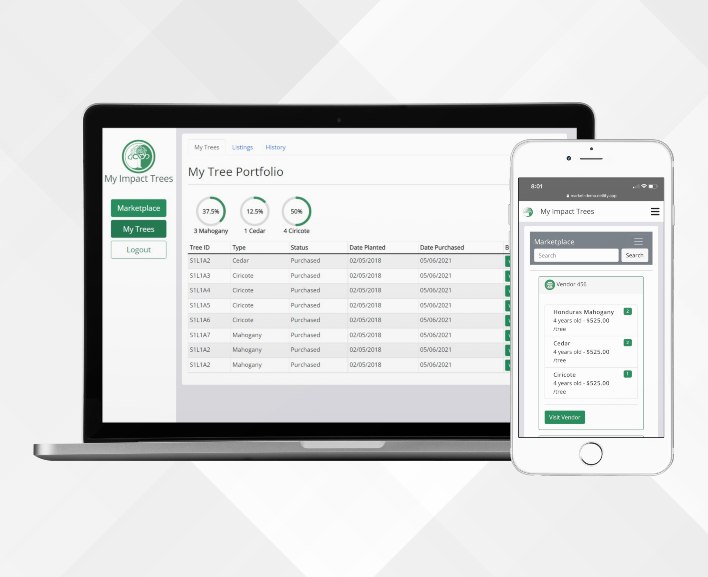

Internal Marketplace

Released during the summer of 2022, we have launched an internal marketplace where impact investors can manage their impact investment portfolio.

Sell Your Trees

You can resell your tree on the marketplace to other impact investors. We have indexed every tree and know the catalogue value of each tree at any given month.

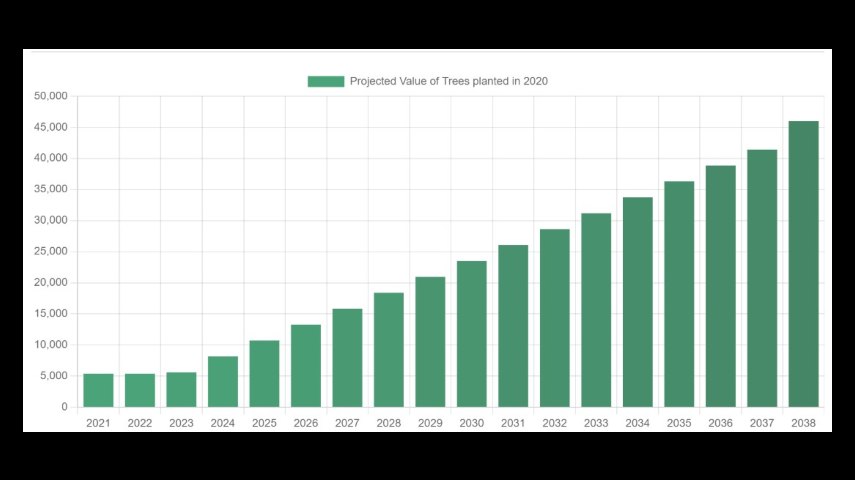

Portfolio Growth

Once your tree has reached 3 years of age you will see your trees catalogue price increase every month. The portfolio management system allows you to track this progress.

Third Party Verification

Open Forest Protocol

Introduction to Open Forest Protocol

Open Forest Protocol (OFP) is a pioneering platform designed to measure, report, and verify forestation data globally. Utilizing blockchain technology, OFP ensures transparent, immutable data for forest carbon projects, enhancing the credibility and accessibility of carbon credits.

Measurement and Reporting

Forestation projects on OFP submit data through a mobile application, which is then stored on the blockchain as non-fungible tokens (NFTs). This process allows for seamless and transparent data collection, ensuring all project information is publicly accessible and immutable.

Third-Party Verification

OFP employs a decentralized network of validators to ensure data accuracy. These validators, including remote sensing companies, environmental NGOs, and research groups, use technologies like satellite imagery and AI to verify reported data, ensuring high reliability and objectivity.

Innovative Technology

By leveraging NEAR's blockchain technology, OFP provides a scalable, efficient, and cost-effective MRV (Measurement, Reporting, and Verification) system. This technology enables multiple validators to independently verify data, enhancing the trustworthiness and scalability of the platform.

Global Impact

OFP supports projects across 20 countries, aiming to expand further by providing tools that reduce financial and logistical barriers for small and medium-sized forest projects. This inclusivity ensures broader participation in carbon markets, contributing significantly to global climate mitigation efforts.

Future Prospects

As carbon markets grow, OFP is poised to become a leading supplier of verified carbon credits. By 2030, the platform aims to support hundreds of thousands of forest projects, providing the infrastructure needed to meet global net-zero goals and foster a data-backed carbon economy.

The Exploding Demand for Tropical Hardwood

Growing Population and Urbanization

Driving demand for high-quality wood products.

Preference for Regenerative and Eco-friendly Products

Consumers are increasingly choosing sustainable options.

Quality and Durability

Emphasis on superior quality and long-lasting materials in construction and furniture making.

Emerging Markets

Economic growth in Southeast Asia, Latin America, and Africa.

Diminishing Supply for Tropical Hardwood

Certification Requirements

Forests must be certified for commercial trade as tropical hardwood trees are protected.

Slow Growth Rates

The slow growth rates of tropical hardwood species limits global annual supply.

Insufficient Agroforestry Plantations

Insufficient numbers of agroforestry plantations currently exist.

Demand Outpaces Supply

Demand outpaces thirst for existing supply.

We Cultivate Valuable

Exotic

Tropical Hardwood Trees

We plant, nurture and harvest 400 tropical

hardwood timber trees on 1

hectare of revitalized land.

On average in a naturally occurring rainforest it takes 1 hectare of land to produce 1 usable and/or

available tropical hardwood tree.

The Investment Opportunity

Participation in an Impact Investment Initiative

Asset Preservation with Exponential Green Returns

Documented Annualized Returns of 40%

US Based Company

| Tree Economics | Amounts |

|---|---|

| Tree Price | $450 |

| Projected Value at Maturity t=18-20 | $4,050 |

| Yearly Value Increase | $225 |

| Year over Year Return | 44% |

| Cash on Cash Return | 800% |

Tree Cost:

| Years | Tree Catalogue Price | Cost/Tree |

|---|---|---|

| 1-2 | $450 | $72 |

| 3 | $675 | $21 |

| 4 | $900 | $21 |

| 5 | $1,125 | $21 |

| 6 | $1,350 | $21 |

| 7 | $1,575 | $21 |

| 8 | $1,800 | $21 |

| 9 | $2,025 | $21 |

| 10 | $2,250 | $21 |

| 11 | $2,475 | $21 |

| 12 | $2,700 | $21 |

| 13 | $2,925 | $21 |

| 14 | $3,150 | $21 |

| 15 | $3,375 | $21 |

| 16 | $3,600 | $21 |

| 17 | $3,825 | $21 |

| 18 | $4,050 | $21 |

| 19 | $4,050 | $21 |

| 20 | $4,050 | $21 |

Tree Returns & Liquidity Options

Timber is No Longer a Long-Term Asset… Unless you want it to be!

Investment Example

Example Purchase/Investment: $250,000.

Ownership of 444 trees (includes management). This investment

covers the cost of tree management and ensures the health and growth of your timber assets over time,

providing an investment experience with potential for significant returns.

| Years | Estimated Tree Catalogue Price |

|---|---|

| 5 years | $500K |

| 10 years | $1M |

| 15 years | $1.5M |

| 18-20 years | $1.8M |

Flexible Exit Strategy

Investments in timber have always been long-term, but with Las Azucenas, you have the flexibility to decide when you want an exit strategy. Our diverse liquidity sources include our internal marketplace, third-party liquidity funds, short-term maturity investment funds, and end users/buyers from various industries such as furniture, construction, shipbuilding, flooring, and veneer production.

Diverse Liquidity Sources

Las Azucenas offers multiple avenues to liquidate your investment. These include our internal marketplace, which provides direct selling opportunities, as well as third-party liquidity funds and short-term maturity investment funds. Additionally, end users in various industries such as furniture, construction, shipbuilding, flooring, and veneer production ensure a consistent demand for your timber assets. Please note that while these options are available, the realization of liquidity is not guaranteed.

Tax Deductions and Ownership Structure

Direct Asset Ownership

Invest in timber with direct asset ownership. Each tree is individually owned through a Bill of Sale, geo-located, and inventoried. This structure provides clear and tangible ownership of your investment, offering transparency and accountability in asset management.

Tax Deductible Opportunities

Tree purchase and cultivation costs are potentially tax-deductible. We recommend consulting with a Certified Public Accountant (CPA) to understand the specific tax benefits that may apply to your investment, maximizing the financial advantages of your timber investment.

Management and Protection

With a Management Agreement in place, your trees are managed, cultivated, and protected professionally. This agreement ensures that your investment is well-maintained. Ownership can be structured as Fee-Simple Ownership or Leasehold Estate, providing flexibility in how you manage your assets.

Sustainable Investment and Wealth Transfer

Strengthen your Sustainable Investment/ESG ratings by investing in timber. This type of investment is not only environmentally responsible but also a fantastic way to transfer generational wealth, ensuring long-term value and sustainability for your portfolio.

Verified Carbon Sequestration

World Average CO2 Footprint

Per person, per year is 6 tonnes.

Carbon Absorption by Trees

A Tropical Hardwood Tree absorbs on average 3 tonnes in 18 years.

Offsetting Emissions

It takes an investment of 2 tropical hardwood trees per person, per year to offset the emissions.

Tangible Carbon Investment

Sequestering CO2 and Asset Growth

Investing in Tropical Hardwood Trees not only sequesters CO2 but also creates an asset which rapidly increases in value over time.

Direct Purchase and Cost Efficiency

You can eliminate intermediaries by buying your tree(s) directly from a reputable forester. Whether you buy one tree or 100,000+, each tree costs $450.

Tree Management and Sales

Contract with a management company to care for your trees. Owning your trees gives you control over the entire sales process.

Geolocation and Certification

Each tree comes with a distinct geolocation and a certificate of transfer history. We're here to support you every step of the way!

Carbon Credits vs Tree Carbon Sequestration Model

| Carbon Credit Model | Tree Carbon Sequestration Model |

|---|---|

| Abstract Nature: Represents intangible emissions reductions from various projects, making it difficult for stakeholders to visualize impacts. | Tangible Carbon Investment: Investing in tree planting not only sequesters CO2 but also creates a valuable asset in the form of tropical hardwood trees, which increase in value over time. |

| Market Dependency: Relies on global market dynamics and pricing, which can fluctuate and complicate planning. | Ecological Interaction: Directly influences local ecosystems, offering measurable and observable environmental benefits. |

| Regulatory Complexity: Involves intricate international and local regulatory frameworks that can be challenging to navigate. | Community Involvement: Engages local populations in planting and maintenance, creating a direct connection to the offsetting effort. |

| Verification Challenges: Subject to risks of double counting and requires robust systems to ensure integrity, which can be opaque. | Third-Party Verification: Allows for straightforward measurement and monitoring of carbon sequestration, enhancing trust. |

| Indirect Impact: Provides financial support to projects but does not necessarily involve direct action by the credit purchaser. | Long-Term Presence: Trees provide a lasting, visible landmark of environmental commitment and improvement. |

Jobs Creation Impact

Long Term Employment

When The Las Azucenas – Good Always Alliance establishes a forest, we generate long term employment which affords resources to the local communities. Good Always provides education in these remote communities.

Preservation of Mayan Culture

Las Azucenas has created 100’s of jobs for local indigenous people. As trees are a sacred part of the Mayan way of life; Las Azucenas is helping preserve the Mayan culture.

Mayan Managed Initiative

A unique aspect of our Impact Investment is that it is a Mayan managed initiative. Mayans are the landowners. They are the creators of the methodology being used to change the way the world is cultivating tropical hardwood trees; and restoring derogated land into biospheres.

Biosphere Restoration

The Las Azucenas Mayan team members are some of the original innovators of the UNESCO Mayan Biosphere. Local villagers are learning valuable cultivation and land restoration skills. These skills are creating a greener environment for us all.

Stones of Light Education Foundation

$495 provides a student with a Complete Blended (Online and Classroom) Education for an entire year!

| Scholarship Disbursements | |

|---|---|

| Scholarships a student for a year | $230 |

| Delivers a student with a Smartphone/Tablet for one year | $120 |

| Pays for a student’s certified mentor-teacher for one entire school year | $145 |

Love Is The Answer! Now, What Was Your Question?©

Grow Your Knowledge, Grow Your Wealth

Request Special Reports

The FREE "Secrets of the Wealthy Profit Kit" will help you make a wise decision about whether or not high-value timber is right for you.